Audience Trends in NZ

Audience Trends in New Zealand:

Over the last 10 years we have seen a revolution in our media consumption habits, driven by the ubiquity of smartphones, the rise of social media and the rollout of broadband. Despite the pleasure we take in complaining about their prices (which are still high enough to exclude some), this country has now had relatively cheap and fast and plentiful data, at home and away from it, for years. And it has transformed our behaviour in alternately exciting and confronting ways.

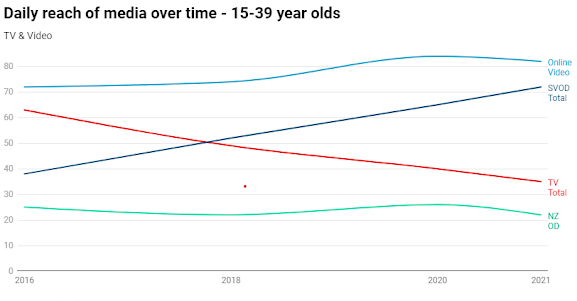

Netflix and YouTube have replaced linear TV for under 40s

Their use of linear television has almost halved in just five years, a staggeringly fast drop. What they do instead is streaming. As the chart shows, online video – particularly YouTube – remains very strong. But it’s subscription video, or SVOD, which has risen most steeply, to functionally replace television as the core platform for this half of the population. This category is dominated by Netflix, which is now in a massive 64% of households – this is higher than Sky TV at its height, and not far off the number of households with a working television (76%).

Two things to remember about Netflix: it’s got hardly any New Zealand content on it and does nothing to push its users toward what NZ content is there. And it is entirely ad-free, meaning those wanting to influence and communicate with that audience, from business to government, have to try and find them elsewhere.

The youngest New Zealanders surveyed (it starts at 15 – we can only assume that the characteristics of those under that age are even more pronounced) are the starkest reminder we have of the stakes here. Those aged 15-24 are roughly three times as likely to watch online video (91%) as linear television (36%). Similarly for streaming music (81%) over radio (31%). Newspapers, a decade ago fairly commonplace, are a daily habit for a quarter of the population as a whole, but only 7% of those aged 15-24.

It's telling that some platforms which didn't even exist when the survey started, or weren't particularly relevant, are now dominant in this demographic. Instagram has a 20% daily reach across all of us, and TikTok an impressive 11% – but among 15-24 year olds Instagram reaches 56% daily and TikTok 39%. They are the platforms of the future – for now.

This survey definitively shows that continuing the way we used to is an indefensible strategy. The most important question is how best to respond. The old models were predicated on big audiences and predictable behaviour. The new one relies on infinite niches, with consumption built by algorithm, and behaviour in constant flux. The most enticing platforms are locked behind subscription paywalls and thus largely inaccessible to NZ on Air’s current funding criteria. Most importantly, the great digital migration has been characterised by an enormous shift from platforms owned and controlled within this country, to platforms owned and controlled elsewhere, largely in Northern California.

Which is to say that responding to this will be incredibly difficult. For those in media, in advertising, in communications and in government, it is incredibly confronting. Yet it cannot be ignored or denied. In an era where good information is life and death, and ties which once bound us are fraying, figuring this out ranks as one of the more important tasks we face as a society.

Key findings:

- Online video narrowly reaches the most New Zealanders each day but SVOD and podcasts are the only media to have grown the size of their daily audiences in the past 12 months.

- New Zealanders continue to spend significantly more time watching TV (118 mins) than using any other media, but the gap is closing. SVOD comes next at 86 mins then radio at 74 mins.

- Traditional media still attracts the biggest audiences in some key time zones – for example TV still reigns supreme from 6 - 8.30pm. From 8.30pm onwards SVOD and Online video are challenging TV for audience size.

- Free to air TV continues to hold a steady audience, with the fall in pay TV subscriptions contributing to a lower overall TV figure.

- TVNZ 1 has the highest overall daily audience reach at 41%.

- Netflix is the only main provider to grow its audience in the past 12 months now at 40% - up from 14% in 2016.

- TVNZ On Demand is the clear leader in local OD sites at 17% - a drop on last year due to COVID boosting viewing but still a steady climb since 2014.

- Debuting strongly in this survey this year are Instagram (20% daily reach) and TikTok (11%) but among 15-24 yr olds Instagram reaches 56% daily and TikTok 39%.

There are three distinct generations of media use:

- 15-39s where digital media dominates – 82% use online video daily, 72% SVOD and 68% music streaming. Radio is at 36% and TV at 35%.

- 40-59s who use a wider range of media – TV is still top at 61% but online video is at 58%, and SVOD and radio are equal on 48%.

- 60+ where traditional media dominates and digital is not growing – 83% use TV daily and 65% radio – online video 26% and SVOD 22%.

Comments

Post a Comment